8 Sustainable Investing: Nurturing a Greener Future through Financial Consciousness

8 Sustainable Investing: Nurturing a Greener Future through Financial Consciousness – In recent years, sustainable investing has emerged as a powerful force, reshaping the landscape of financial markets. As investors increasingly prioritize environmental, social, and governance (ESG) factors, sustainable investing goes beyond profit-seeking to create positive societal and environmental impacts. This article delves into the world of sustainable investing, exploring its principles, growth, and the profound influence it has on both financial portfolios and the world at large.

1. Understanding Sustainable Investing

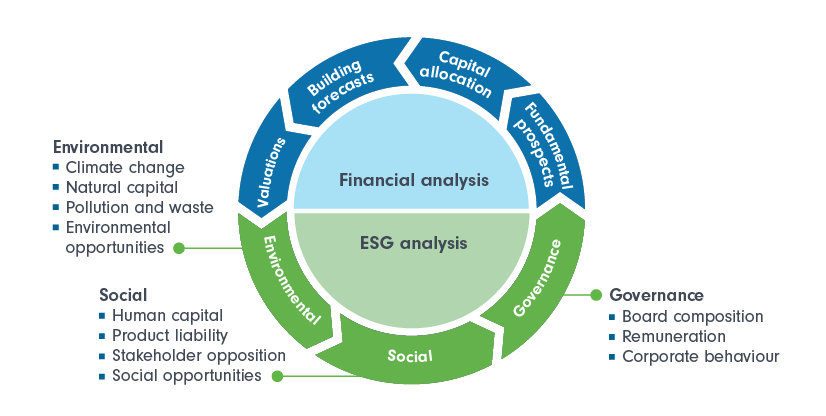

Sustainable investing, often referred to as responsible or ethical investing, revolves around integrating ESG criteria into investment decisions. This approach seeks to align financial returns with ethical considerations, ensuring that investments not only yield profits but also contribute to a more sustainable and equitable world. ESG factors encompass a wide range of considerations, including a company’s environmental impact, social responsibility, and corporate governance practices.

2. The Growth of Sustainable Investment Strategies

The trajectory of sustainable investing has witnessed significant growth in recent years. Investors are increasingly recognizing the potential for both financial returns and positive societal impact. According to various reports, sustainable investments have consistently outperformed traditional counterparts, challenging the myth that ethical considerations come at the expense of financial gains. This growing trend indicates a paradigm shift in investor attitudes towards long-term value creation.

3. Positive Impact on Environmental Sustainability

Sustainable investing channels funds into businesses and projects that prioritize environmental conservation and sustainable practices. This includes investments in renewable energy, energy-efficient technologies, and companies committed to reducing their carbon footprint. By directing capital towards eco-friendly initiatives, sustainable investing plays a crucial role in fostering a transition to a more sustainable and low-carbon economy.

4. Socially Responsible Investments (SRI)

Socially responsible investments focus on supporting businesses that prioritize positive social impacts. This can involve investments in companies promoting fair labor practices, diversity and inclusion, and community development. SRI strategies aim to align investments with values that contribute to the well-being of society, fostering a more inclusive and socially conscious approach to wealth creation.

5. Corporate Governance and Ethical Practices

Sustainable investing places a spotlight on corporate governance, emphasizing transparency, accountability, and ethical business practices. Investors actively seek companies with robust governance structures, diverse and independent boards, and a commitment to ethical conduct. This approach not only mitigates risks associated with corporate malfeasance but also supports businesses that prioritize ethical decision-making.

6. The Rise of Impact Investing

Impact investing takes sustainable investing a step further by actively seeking investments that generate measurable and positive social or environmental impacts. Investors employing impact strategies are motivated by the desire to contribute to solutions for pressing global challenges. This approach aligns financial goals with a broader mission of creating meaningful change, demonstrating that profit and purpose can coexist. (Read More: Property Investment on the Rise: Unveiling Opportunities in a Growing Market on 2024)

7. Green Bonds and Sustainable Financial Instruments

The financial market has responded to the rise of sustainable investing with the introduction of innovative financial instruments, such as green bonds. These bonds are specifically earmarked for environmentally friendly projects, providing investors with a tangible way to support sustainability initiatives while earning returns. Sustainable financial instruments cater to a growing demand for investment vehicles that align with ethical and environmental considerations.

8. Challenges and Opportunities for Sustainable Investing

While the momentum behind sustainable investing is undeniable, challenges persist. Issues such as standardization of ESG metrics, greenwashing, and the need for consistent regulatory frameworks are areas that require attention. However, these challenges also present opportunities for innovation and collaboration within the financial industry to further refine and enhance sustainable investment practices.

Conclusion: A Future Aligned with Values

In conclusion, sustainable investing is not merely a trend; it represents a fundamental shift in how investors perceive their role in shaping the world. The integration of ESG criteria into investment decisions is steering capital towards businesses that prioritize sustainability, ethics, and positive social impact. As the world grapples with pressing challenges such as climate change and social inequality, sustainable investing emerges as a beacon of hope, demonstrating that financial decisions have the power to create a better, more sustainable future for generations to come.

Read More : The Role of Technology in Business Transformation on 2024: A Catalyst for Evolution