8 Strategies for Dealing with Market Volatility: Navigating Turbulent Waters with Confidence

8 Strategies for Dealing with Market Volatility: Navigating Turbulent Waters with Confidence – Market volatility is an inherent aspect of financial markets, characterized by sudden and unpredictable price fluctuations. While it presents opportunities for gains, it also poses risks that can unsettle even the most seasoned investors. This article explores various strategies for effectively dealing with market volatility, helping investors navigate turbulent waters with confidence and resilience.

1. Diversification: Building a Robust Portfolio Foundation

Diversification remains a cornerstone strategy for managing market volatility. By spreading investments across different asset classes, industries, and geographic regions, investors can mitigate the impact of downturns in any single area. A well-diversified portfolio provides a buffer against the volatility of individual stocks or sectors, enhancing overall risk management.

2. Staying Informed: Knowledge as a Shield

In times of market volatility, information is a powerful tool. Staying informed about economic indicators, geopolitical events, and industry trends allows investors to make informed decisions. Regularly monitoring the financial news and leveraging research resources can provide valuable insights into potential market movements, helping investors anticipate and react to changing conditions.

3. Long-Term Perspective: Riding Out Short-Term Fluctuations

Adopting a long-term investment perspective helps investors weather short-term market fluctuations. Instead of reacting impulsively to day-to-day volatility, focusing on the underlying strength of investments and their growth potential over time can instill a sense of stability. This strategy encourages a patient approach, recognizing that markets tend to recover over more extended periods.

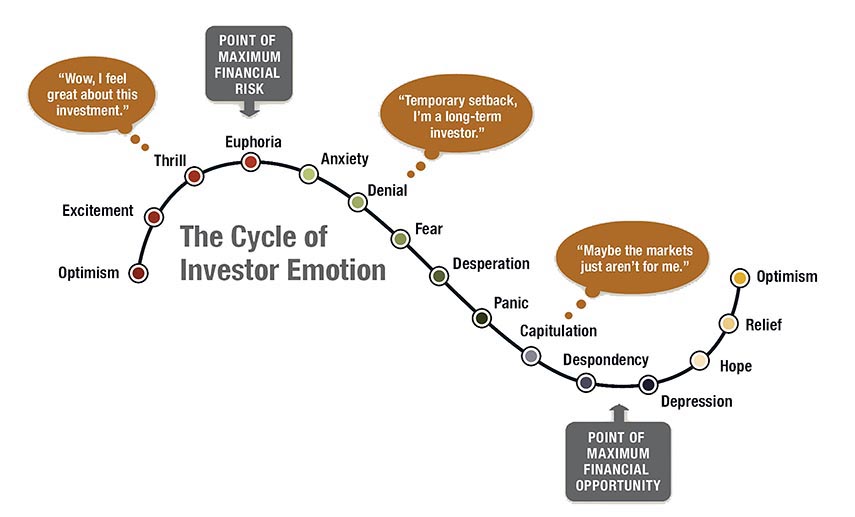

4. Setting Realistic Expectations: Managing Risk and Reward

Establishing realistic expectations is crucial in managing the emotional toll of market volatility. Recognizing that markets inherently fluctuate and that losses are a natural part of investing helps investors maintain a disciplined approach. By understanding the balance between risk and reward, investors can make more rational decisions based on their financial goals and risk tolerance. (Read More : 8 Sustainable Investing: Nurturing a Greener Future through Financial Consciousness)

5. Utilizing Stop-Loss Orders: Automated Risk Management

Stop-loss orders can be an effective tool for automating risk management. These orders automatically sell a security when it reaches a predetermined price, limiting potential losses. While stop-loss orders do not guarantee protection against all market conditions, they can serve as a proactive measure to minimize losses during sudden downturns.

6. Regular Portfolio Reassessment: Adapting to Changing Conditions

Regularly reassessing and rebalancing a portfolio is crucial in adapting to changing market conditions. As market dynamics evolve, certain asset classes or sectors may outperform or underperform. Periodically reviewing and adjusting the allocation of assets ensures that the portfolio remains aligned with the investor’s goals and risk tolerance.

7. Cash Reserves: Building a Safety Net

Maintaining a portion of the portfolio in cash can provide a safety net during periods of market volatility. Having available cash allows investors to capitalize on investment opportunities that may arise during market downturns. Additionally, it provides a source of liquidity to meet short-term financial needs without being forced to sell assets at unfavorable prices.

8. Professional Guidance: Tapping into Expertise

Engaging with financial advisors or professionals can offer valuable guidance during volatile market conditions. Experienced professionals can provide a measured perspective, help investors navigate uncertainty, and tailor strategies to individual financial goals. Their expertise can be particularly beneficial for those who may find market fluctuations overwhelming or challenging to navigate independently.

Conclusion: Building Resilience in the Face of Market Volatility

In conclusion, market volatility is an intrinsic element of investing, and developing effective strategies to deal with it is essential for long-term success. Diversification, staying informed, maintaining a long-term perspective, and utilizing risk management tools are among the key strategies to navigate turbulent markets. By adopting a resilient and disciplined approach, investors can withstand market fluctuations and position themselves for financial success over the long term.

Read More : The Role of Technology in Business Transformation on 2024: A Catalyst for Evolution